These Indian industries can’t function without stainless steel

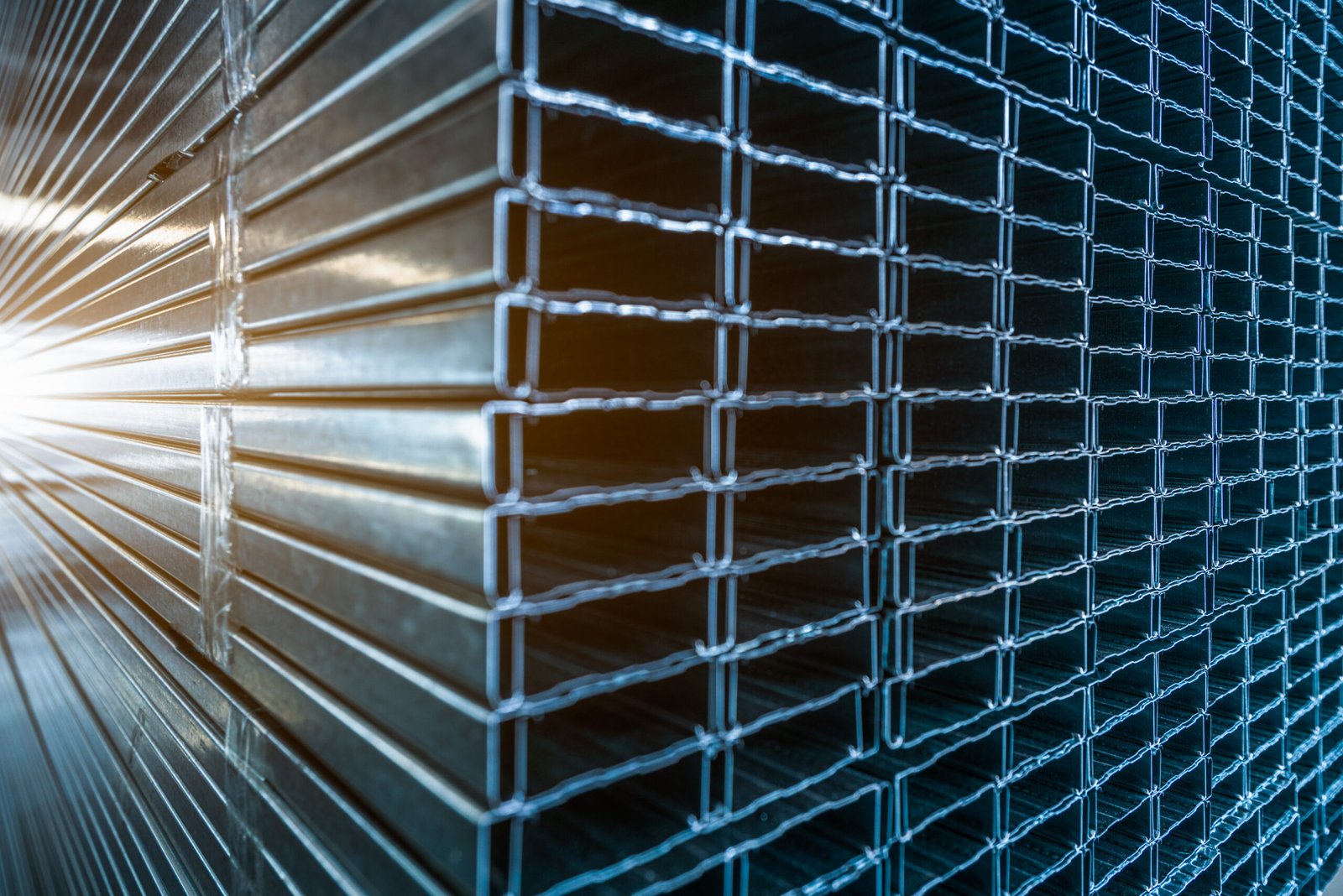

Stainless steel is a quiet workhorse of modern industry. Durable, hygienic and corrosion-resistant, it sits in plain sight from the pots in a household kitchen to the pipelines that move petrol across the country and underpins entire sectors of India’s manufacturing and infrastructure push.

For the leaders planning supply chains, specifying materials or sizing capacity, understanding which industries consume the most stainless is no longer academic. It informs procurement, product design and long term strategy. This feature maps the principal end users of stainless steel, highlights Indian companies on both the supply and user side, and closes with an outlook for how India’s stainless landscape could evolve.

Why stainless steel matters now

Stainless steel’s appeal is practical. It offers long life, low maintenance, safety as it does not flake or contaminate, and strong life cycle economics. These properties make it the material of choice where durability and hygiene matter, such as kitchens, food processing, pharmaceuticals, water systems and many process industries.

For policy makers and corporate planners, the result is predictable. As India urbanises, builds large public projects and scales food, pharma and energy manufacturing, stainless consumption rises with them. Industry bodies estimate domestic stainless consumption has been growing strongly. ISSDA reported roughly 4.8 to 4.85 million tonnes for FY24 to FY25, an increase of about eight percent year on year, and forecasts continued mid single to high single digit growth over the next few years.

Top users of stainless steel: the sectors you need to watch

- Metal products and household goods, including kitchenware

Surprisingly to some corporate readers, the largest single end use for stainless steel in India remains metal products and kitchenware. Household items, sinks, cookware and small kitchen appliances use vast volumes of relatively low alloy stainless grades. In India, this segment has historically accounted for a significantly larger share of consumption than in many Western markets. This makes upstream players and fabricators particularly sensitive to consumer income cycles and changing retail patterns.

Companies that supply thin-gauge flat products, blanking and forming services, or operate co-branding partnerships with appliance and kitchen brands tend to see steady baseline demand even when larger industrial orders fluctuate.

- Construction, architecture and urban infrastructure

The visual appeal of stainless steel, especially its polish and permanence, has made it a preferred choice for façades, cladding, handrails and structural elements in premium projects. Beyond aesthetics, stainless is increasingly specified in metro rail systems, airports and public transport nodes due to its low maintenance needs and long service life in exposed environments. The ongoing construction and infrastructure push under national urban missions and metro expansion has therefore pulled significant volumes of stainless. ISSDA and sector reports consistently point to construction and transport as fast-rising end-user categories.

- Automotive and transport

In the automotive sector, stainless steel adoption is driven by function rather than appearance. Exhaust systems, fuel systems, certain chassis components and rail coach bodies increasingly use stainless grades for corrosion resistance and improved life cycle costs. As India scales up bus and rail manufacturing and as OEMs seek to extend service intervals and improve resale value, demand from transport manufacturers remains a dependable growth corridor. Industry listings and OEM parts catalogues show stainless being widely used in exhaust systems and tubular components across mainstream vehicles.

- Process industries including petrochemicals, oil and gas, chemicals and fertilisers

Process industries demand higher grade stainless steels for piping, reactors, heat exchangers, storage vessels and valves that must withstand corrosive media and extreme temperatures. Engineering, procurement and construction companies along with specialist fabricators, therefore form a large and technically demanding customer base for premium stainless grades and advanced fabrication services. Major Indian EPC players and refinery operators routinely specify stainless steel for critical units, making this segment a steady and high-value source of orders for mills and processors.

- Food and beverage, dairy and pharmaceuticals

In food and pharmaceutical manufacturing, hygiene is the primary driver. Stainless steel is almost mandatory for contact surfaces, storage tanks and processing equipment where cleanliness, sterilisation and regulatory compliance are non-negotiable. As India’s organised food processing, dairy and pharmaceutical sectors continue to expand and as export markets demand higher international standards, stainless demand from sanitary fittings, tanks, piping systems and clean room equipment continues to rise. ISSDA and industry studies consistently identify food and pharma as core value-driven markets for stainless steel.

- Water, desalination and power plants

Water infrastructure also plays a growing role. Stainless steel piping is increasingly used for potable water systems, desalination plants and auxiliary equipment in power plants to minimise corrosion and extend service life. Public investment in water infrastructure and renewable energy projects, including balance of plant components for hydrogen and battery storage applications, is pushing more project specifications towards stainless alloys. EPC companies with strong heavy fabrication capabilities are seeing new enquiries from utilities and state water boards.

Who in India is buying and building with stainless steel

India’s stainless steel story is not only about producers. It is also about end users who transform steel into systems, assets, and infrastructure. Several names stand out:

Jindal Stainless remains India’s largest stainless steel producer and a bellwether for domestic demand trends and pricing. Beyond primary production, the company is active in downstream and consumer-facing products, and its public commentary often reflects wider industry sentiment on demand growth and import pressures.

The Tata Group, through companies such as Tata Motors and Tata Steel affiliates, is a significant user of stainless steel across automotive, infrastructure, and industrial segments. Automotive OEMs and their suppliers use stainless steel in exhaust and fluid systems, while Tata’s wider industrial footprint spans process industries and large-scale infrastructure projects.

Maruti Suzuki, as India’s largest passenger vehicle manufacturer, uses stainless steel extensively in exhaust systems and select vehicle components, either directly or through its tier one supplier network.

Larsen and Toubro is another major stainless steel consumer. As a leading EPC and heavy engineering firm, L&T fabricates stainless steel pressure vessels, piping systems, and components for nuclear, refinery, and chemical projects. Its special fabrication units are among the largest buyers of high-grade stainless in the country.

Reliance Industries and other major refinery and petrochemical operators specify stainless steel for critical process units where corrosion resistance and safety are paramount. Reliance’s integrated petrochemical operations make it a consistent and high-volume consumer of specialised stainless alloys.

In the food and pharmaceutical space, large processors such as Britannia, Amul, and leading contract manufacturers drive steady demand for stainless steel equipment, even though individual supplier contracts remain confidential. The broader trend points to growing stainless intensity as compliance and export volumes increase.

Indian Railways and rolling stock manufacturers are also important end users. Metro and rail coach projects increasingly specify stainless steel for car bodies and interiors due to its durability and suitability for high traffic public transport environments.

Fabricators need to monitor EPC tender pipelines closely. Mills and traders must align grade availability with process industry requirements. OEM suppliers can explore stainless substitution where life cycle economics support the shift.

Voices from the industry

Industry leaders speaking at recent conferences and at the Global Stainless Steel Expo have been open about both opportunities and challenges. ISSDA President Rajamani Krishnamurti noted that India’s stainless steel consumption reached around 4.8 million tonnes in FY25 and that demand is expected to grow at seven to eight percent annually over the next two to three years. He highlighted infrastructure, railways, and metro projects as key growth drivers.

At the same event and in related media interactions, leadership at Jindal Stainless cautioned against rising import competition and emphasised the need for policy support. Managing Director Abhyuday Jindal has pointed out that low-priced imports continue to put pressure on domestic pricing, influencing margins and capital investment decisions for Indian producers.

Together, these perspectives capture the current commercial reality. Demand fundamentals are strong, but policy clarity and supply chain stability remain critical factors for long-term planning.

The challenges

Import competition and price volatility continue to affect the domestic market. Finished stainless imports from neighbouring countries have periodically depressed local plate and coil prices, prompting calls for safeguard measures. This directly influences contract pricing and inventory strategies.

Another concern is the mismatch between grade requirements and fabrication capability. Many end users need high-quality austenitic or duplex grades along with precision fabrication skills such as advanced welding and surface treatment. Not all regions currently offer this capability, creating opportunities for specialised fabricators and workforce training initiatives.

Carbon considerations and raw material sensitivity are also growing in importance. Fluctuations in nickel and chromium prices, along with pressure to reduce embodied carbon, mean procurement teams must carefully balance alloy choice with ESG goals. Mills and buyers are increasingly exploring substitution strategies and circular economy approaches.

Future outlook for India’s stainless steel uses

For India’s ecosystem, stainless steel is moving beyond the cycles of a traditional commodity and into a phase of structural growth. Per capita stainless consumption in India remains well below global averages, indicating significant headroom across household, construction and industrial applications. ISSDA and major producers continue to project steady mid to high single digit growth, supported by infrastructure development, rail and metro expansion, growth in food and pharmaceutical processing, and rising technical demand from petrochemical and energy sectors.

Two practical takeaways stand out. Supply chain players such as mills, traders and fabricators should invest in grade diversity and closer integration with EPC and OEM procurement systems. At the same time, end users and project specifiers should treat stainless steel not merely as a cost input but as a long-term asset. Selecting the right grade, ensuring fabrication quality and planning maintenance can deliver significant value over decades.

Policy will play a decisive role. Industry calls for a dedicated stainless steel policy and targeted safeguard measures signal a push for a more stable and investment-friendly environment. Buyers would do well to track regulatory developments closely, as they will shape pricing dynamics, domestic capacity and the competitive landscape of India’s stainless steel industry in the years ahead.