Auto stainless steel demand soars as India scales up EVs

The global automotive stainless steel market is expected to jump from USD 116.71 billion in 2025 to USD 180.72 billion by 2031. With India emerging as a major vehicle manufacturing hub, can rising EV output, lightweighting needs, and sustainability goals turn the country into a key growth engine for this fast-expanding market?

Strong growth outlook puts India in focus

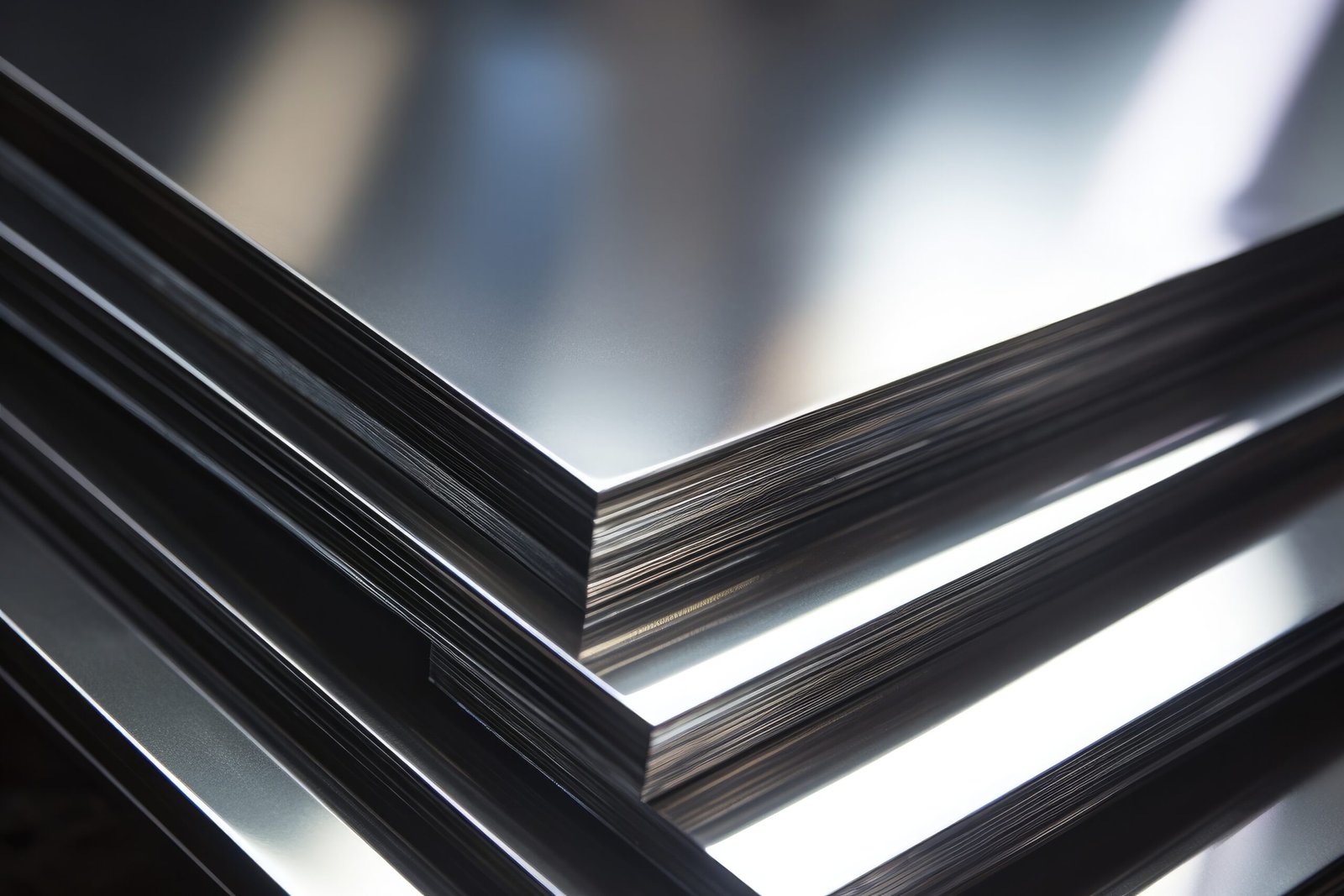

Automotive stainless steel is valued for resisting rust and being strong yet lightweight, making it common in exhaust systems, fuel lines, and structural trims. Global demand is rising as carmakers shift towards lighter vehicles to improve fuel efficiency and meet emission norms.

India stands to benefit from this trend. As one of the world’s fastest-growing automotive markets, the country is seeing steady growth in passenger and commercial vehicle production, along with rapid expansion in electric vehicles. This is driving higher demand for durable materials such as stainless steel, especially for EV battery enclosures and long-life components. Globally, shipments of corrosion-resistant steel sheets increased in 2025, with automotive applications playing a major role.

Cost pressures and trade risks remain challenges

Despite strong demand, the market faces headwinds from volatile raw material prices and trade-related disruptions. Stainless steel relies on alloying elements like nickel and chromium, whose prices often fluctuate due to global supply constraints and geopolitical tensions.

For Indian manufacturers and suppliers, this creates uncertainty in long-term sourcing and pricing strategies. Cost instability can squeeze margins and delay investment decisions, even as domestic vehicle demand remains healthy. Global trade barriers and tariffs also add pressure to supply chains, affecting overall production planning across regions.

Sustainability and EVs shape future demand

Sustainability is becoming a key driver in material selection. Automakers are increasingly opting for low-emission or “green” stainless steel to reduce carbon footprints across vehicle lifecycles. This shift supports India’s broader push towards cleaner mobility and local manufacturing under long-term policy initiatives.

At the same time, stainless steel is gaining importance in next-generation technologies, including hydrogen fuel cell vehicles, due to its durability and conductivity. Asia Pacific already leads the global automotive stainless steel market, supported by high output in countries such as China, India and Japan, as highlighted by data from the International Organization of Motor Vehicle Manufacturers.

With rising EV adoption, tightening emission norms, and a strong domestic manufacturing base, India is well placed to play a larger role in the global automotive stainless steel market over the coming decade.