India’s Stainless Steel Market Stays Subdued as Demand Weakness Continues

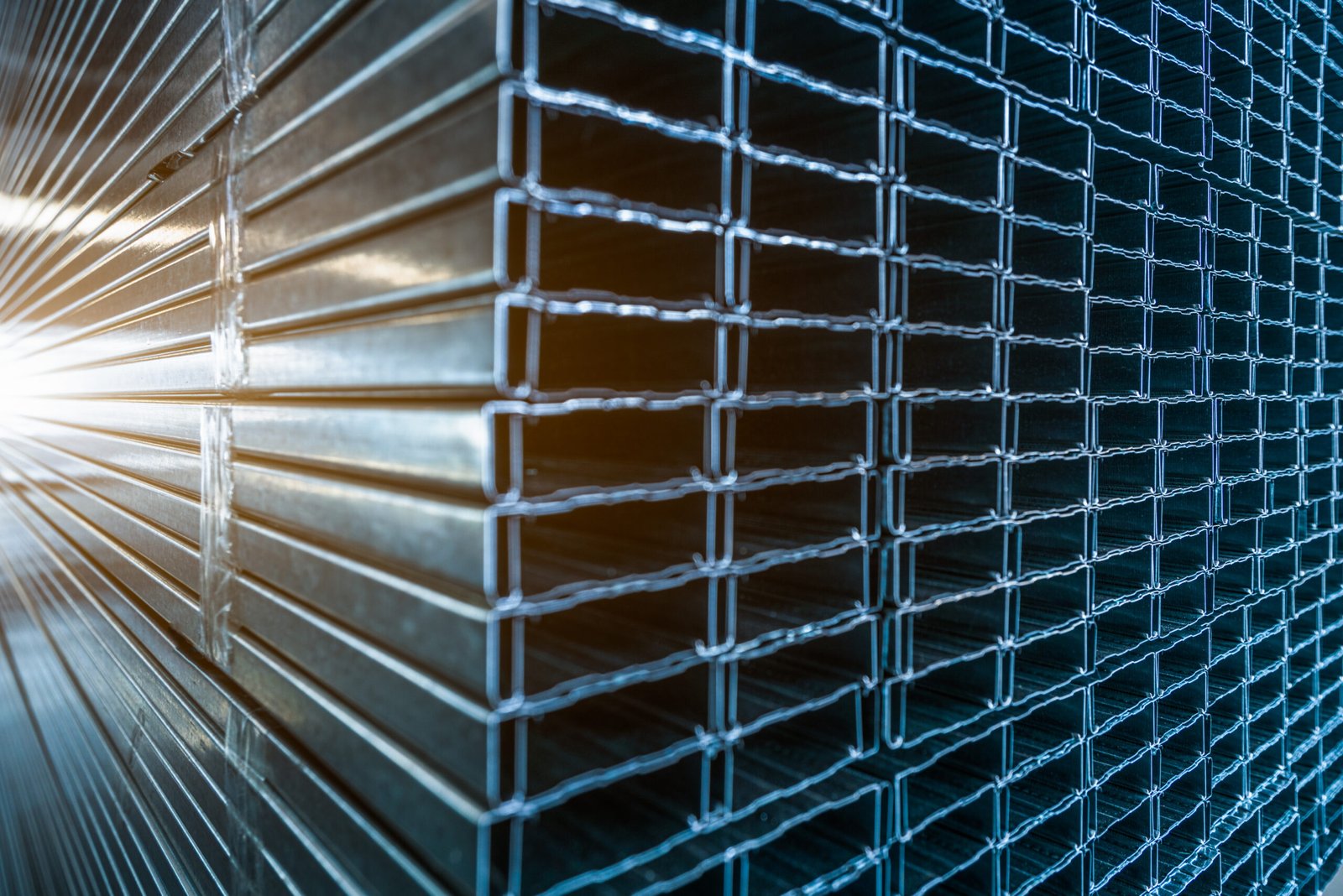

Close-up of the texture of stainless steel.

India’s stainless steel flats and longs market stayed quiet this week. Prices held steady, but demand across both segments remained weak. BigMint assessed 304-series hot-rolled coils (HRCs) at Rs 192,000/t ex-Mumbai, with no change from last week. Similarly, 304L black round bars (25-100mm) stood firm at Rs 160,000/t. In contrast, 316-series HRCs stayed at Rs 345,000/t, while cold-rolled coils (CRCs) edged up by Rs 1,000/t to Rs 351,000/t week-on-week.

Despite stable prices, downstream demand from utensils, cutlery, hinges, and tubes failed to pick up. Moreover, non-tariff barriers in export markets added pressure. At home, rising pipe and tube prices discouraged new buying.

The stainless steel longs market faced more challenges. Seasonal factors such as monsoon disruptions, festive holidays, and the Diwali season slowed fresh enquiries. Export prospects also dimmed, as US tariffs and currency swings hurt overseas orders. Traders and mills agreed that prices looked moderate, yet buyers showed little appetite for fresh deals.

Three-month nickel on the London Metal Exchange (LME) stood at US $15,235/t, down slightly from US $15,275/t last week. Nickel stocks at LME warehouses rose to 231,312 t, up 0.37 per cent from 230,454 t earlier.

In China, 304-grade CRCs traded at RMB 13,750/t (US $1,931/t) ex-works. FOB prices for 304-grade CRCs held at US $1,930/t. Nickel pig iron (NPI) prices stayed stable as well. Portside NPI (8-12 per cent) stood at RMB 955/t (US $134/t), while Indonesian FOB NPI (12-14 per cent) held at US $118.59/t.

Ferro molybdenum in India slipped by Rs 16,000/t (US $180/t) from 24 September levels. Prices stood at Rs 3,068,000/t (US $34,602/t) ex-works. Around 70 t of trades were reported last week at Rs 3,065,000-3,150,000/t.

Ferro chrome prices dropped by Rs 600/t week-on-week to Rs 118,700/t ex-Jajpur. Meanwhile, ferro silicon (70 per cent) prices fell marginally by Rs 100/t to Rs 88,300/t (US $995/t) ex-Guwahati. In Bhutan, prices slipped by Rs 400/t to Rs 88,000/t (US $992/t) ex-works.

India’s imported scrap market stayed weak as offers failed to attract buyers. Shredded scrap held at US $355-360/t, HMS 80:20 at US $325-330/t, busheling at US $370-375/t, and PNS at US $365-370/t CFR. Domestic scrap stayed cheaper by Rs 1,500-1,800/t, which discouraged imports. Rains, sponge iron trials, and festive slowdowns further weighed on demand.

India’s stainless steel market may remain under pressure in the coming weeks. Weak domestic offtake and cautious buying continue to hurt both flats and longs. The ongoing anti-dumping probe against flat products from China, Indonesia, and Vietnam could improve prospects for local mills over time. However, near-term uncertainty still dominates due to soft demand, poor exports, and global trade headwinds. Seasonal export demand in October-November could bring limited relief, but overall recovery looks slow and uneven.