Jindal Stainless reports strong Q2 growth with Rs 10,893 crore consolidated revenue

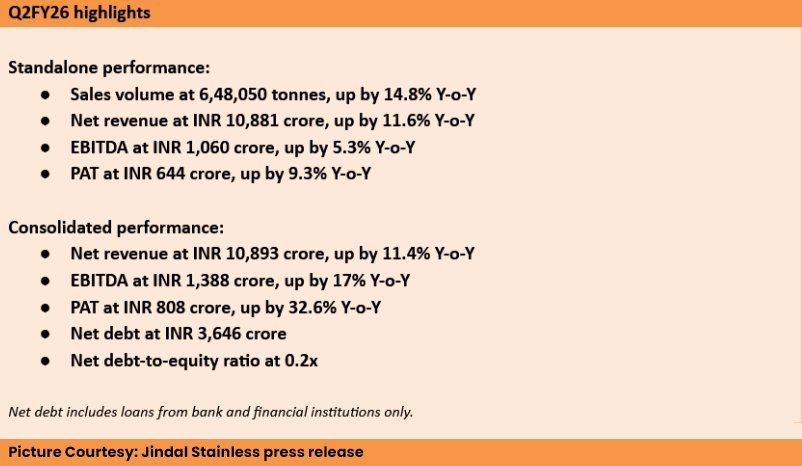

Jindal Stainless Limited (JSL) reported strong financial results for the quarter ended 30 September 2025. The company recorded a sales volume of 6,48,050 tonnes, marking a 14.8 per cent rise year-on-year. Standalone net revenue grew by 11.6 per cent to Rs 10,881 crore.

Standalone EBITDA rose by 5.3 per cent to Rs 1,060 crore, while PAT increased by 9.3 per cent to Rs 644 crore. Consolidated net revenue stood at Rs 10,893 crore, up by 11.4 per cent year-on-year. Consolidated EBITDA reached Rs 1,388 crore, and PAT jumped by 32.6 per cent to Rs 808 crore. The company reported consolidated net debt at Rs 3,646 crore, with a net debt-to-equity ratio of 0.2x.

The company saw steady demand across industrial pipes and tubes, lifts, elevators, metro projects, and railway coaches. The white goods sector also performed well due to festive-season demand. Jindal Stainless continued to strengthen its customer-focused programmes that ensure product authenticity and trust.

Its co-branding initiative, ‘Jindal Saathi Seal’, in pipes, tubes, kitchenware, and sinks boosted partner confidence. Meanwhile, the QR Code Loyalty Programme improved customer engagement and efficiency. With demand staying strong, the company expects consistent growth in upcoming quarters.

However, imports of subsidised and dumped stainless steel from China and Vietnam continued to challenge domestic producers. These imports, entering through Free Trade Agreements, affected fair competition for Indian manufacturers, especially MSMEs. Even so, Jindal Stainless retained its market share through competitive pricing and enhanced services.

On the export front, the company faced weak global trade sentiment due to geopolitical tensions and protectionist measures in key markets like the EU and the US. Despite these headwinds, JSL maintained its export volumes at Q1FY26 levels by serving global customers with value-added products.

Jindal Stainless continues to balance domestic and export demand, focusing on innovation and efficiency. Its strong operational performance reflects the company’s ability to sustain growth amid challenging market conditions.